The cash and cash equivalents at Berkshire Hathaway as of September 30th, 2025, were USD 382 billion. This number is not just a number but a statement. This is a point in time when the world is under the AI cloud, and Warren Buffett has chosen cash over credit. The stock portfolio has been cut down to USD 283 billion, and the company has been steadily selling stocks. This shows Buffett’s philosophy: when the rush of the market leads to a deviation from proper valuation principles, prudence isn’t frugal—it’s a philosophy.

Buffett’s philosophy of the world can be contrasted with the AI-inspired market surge. In fact, as noted recently by writer and investor Ruchir Sharma: “Companies involved in AI development and applications accounted for almost 80% of the American stock market’s increases in 2025.” According to The New York Times, today “seven tech leaders together account for more than one-third of the S&P 500” and trade at “70 times earnings” – a price tag which conflicts sharply with the value investing principles espoused by Berkshire’s Buffett: simple-to-grasp businesses bought at sensible prices – principles which the investor reaffirmed in his 1989 letter to shareholders.

What is the reason behind this extreme difference and what lessons can the burgeoning digital economy of India learn from this?

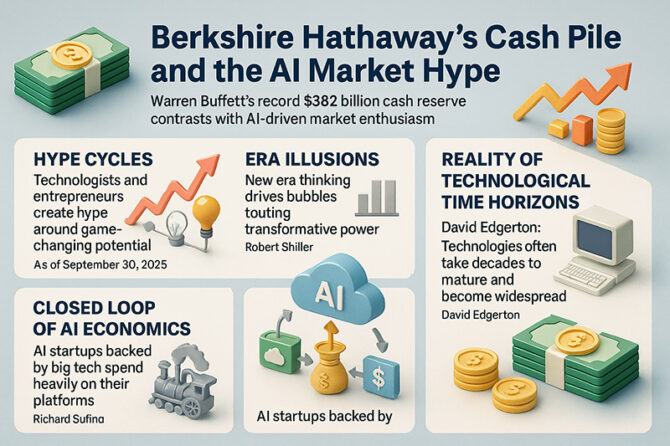

The Power and Peril of Hype Cycles

In fact, each and every technological revolution has been founded upon a promise that has often been hyped up by people who will benefit the greatest from its advents. According to Richard Susskind’s book “How to Think About AI” (2022), the discourse concerning artificial intelligence has been driven in particular by people who work in the technological field and whom the possible benefits of this field will push towards optimism.

However, history makes it clear that the unexpected often occurs when the impossible becomes inevitable.

The dot-com bubble provides a grim reminder. As described in Roger Lowenstein’s ‘Origins of the Crash’ (2004) and Charles Morris’s ‘Trillion-Dollar Meltdown’ (2008), the misconception that the traffic on the internet was doubling every three months—absent empirical verification—is what prompted the telecommunication giants to create this unused network capacity. The truth has had a way of bursting the myth.

This trend has been there for a long time. During the railway mania of the 1840s in Britain, there were unscrupulous entrepreneurs who used primitive ways of estimating the number of freighted sheep on market day to arrive at outrageous prices. This is compared to “counting sheep on the internet” by Lowenstein.

The message here is clear: stories can be more persuasive than spreadsheets.

New-Era Thinking and Its Illusions

In his book ‘Irrational Exuberance’ (2000), Robert Shiller illustrates the role of “new era thinking” in the growth of financial bubbles: “People believe that the world has entered a new era in which the old rules do not apply. This psychological state of mind launched the South Sea bubble, the Mississippi bubble, the ‘radio stock’ boom of the 1920s in America, and the housing bubble of the early 2000s and its securitization mania.”

Currently, AI fills this psychological slots. Like Indian investors believed in Harshad Mehta’s “asset replacement” theory and Ketan Parekh’s “ICE stocks” gospel, today’s global investors believe that the existence of AI firms marks a new paradigm in the economy and hence deserve infinite price tags.

Emily M. Bender and Alex Hanna point in The AI Con (2024): “Artificial intelligence itself is a marketing label that suggests a capability that’s almost, but not quite, human-like. That’s often not the case.”

Buffett is not affected by these stories. His comment from the 1990s remains valid today: “The fact that people will be full of greed, fear, or folly is predictable; the sequence is not.”

The Closed-Loop of AI economics

One of the less noted trends in the current AI rush has been described as the “circular revenue loop” because of its self-circulating nature. A giant tech company will fund an AI company. The company will then turn around and pay the parent company’s cloud services bill. The parent company will book this as additional revenue. And so the story of validation and financial support will bring in even more investors. This has been described in depth in the tech press circles of The Information and The Wall Street Journal regarding cloud transactions of the startups.

This closed ecosystem creates the illusion of external demand, even though much of the spending is self-referential.

Buffett’s restraint—viewed through this lens—is hardly surprising.

The Reality of Technological Time Horizons

However, this does not preclude the possible benefits of AI. As Susskind points out, there will be short-term efficiency gains and the redefinition of professional boundaries in the medium term. However, transformationary technologies do not break through immediately but develop over several decades. This has been observed in The Shock of the Old (2006) by David Edgerton: “Technologies take far longer to diffuse, mature, and transform economies than their early proponents imagine.”

Examples include:

– A century passed before electric vehicles gained significant traction.

– Steam power only came to drive the machinery of Britain many years later than the innovations of James Watt.

– Personal computers attained popularity almost 30 years after their conceptual development.

– The internet has affected the world of work and of business only in the 2010s—even though the hype occurred in the 1990s.

AI has already experienced several “AI winters,” as mentioned in “The Quest for Artificial Intelligence” by Nils Nilsson, 2010. A possible slowdown would not be unexpected.

India’s View: Opportunity Meets Prudence

The digital landscape of India, which encompasses IT services, fintech, healthcare AI, and the mobility sector, has a lot to benefit from the adoption of AI. The hospitals of the country are already practicing the usage of AI in the radiology field. However, the markets of the country saw many bubbles in the past as well—whether it’s the NBFC bubble or the real estate bubble.

The lesson for India’s retail investors, pension funds, and emerging AI startups echoes Buffett’s philosophy: technology is powerful, but valuation discipline is timeless.

In the words of Infosys co-founder N. R. Narayana Murty: “In God we trust. Everything else bring data.”

Summary: The Strength of Steady Wisdom

People say: Buffett’s cash pile of USD 382 billion may appear outdated in an economy which is fixated on the future. However, history tells us that in periods of euphoria, saying nothing can only be a sign of conviction. As Buffett has famously declared: “Be fearful when others are greedy and greedy when others are fearful.” AI might truly transform the world, but whether the investors of today will be the beneficiaries of this transformation only time will tell. Until then, Berkshire Hathaway will rely less upon prophecy and more upon patience—and patience has often trumped hype in the world of finance.

Dr. Prahlada N.B

MBBS (JJMMC), MS (PGIMER, Chandigarh).

MBA in Healthcare & Hospital Management (BITS, Pilani),

Postgraduate Certificate in Technology Leadership and Innovation (MIT, USA)

Executive Programme in Strategic Management (IIM, Lucknow)

Senior Management Programme in Healthcare Management (IIM, Kozhikode)

Advanced Certificate in AI for Digital Health and Imaging Program (IISc, Bengaluru).

Senior Professor and former Head,

Department of ENT-Head & Neck Surgery, Skull Base Surgery, Cochlear Implant Surgery.

Basaveshwara Medical College & Hospital, Chitradurga, Karnataka, India.

My Vision: I don’t want to be a genius. I want to be a person with a bundle of experience.

My Mission: Help others achieve their life’s objectives in my presence or absence!

My Values: Creating value for others.

Leave a reply

Dear Dr. Prahlada N. B Sir,

Your insightful analysis on Warren Buffett's cash reserve and the AI market surge is a timely reminder of the importance of prudence in investment decisions. As you aptly pointed out, the current AI euphoria is reminiscent of past technological revolutions, where hype often outpaces reality.

The "circular revenue loop" you've highlighted is a concerning trend, where companies create an illusion of external demand, leading to inflated valuations. This phenomenon is a classic example of "new era thinking," where investors believe that traditional rules no longer apply.

In the Indian context, the AI market presents both opportunities and challenges. While AI can drive efficiency gains and redefine professional boundaries, it's crucial to separate hype from reality. The Indian digital landscape, encompassing IT services, fintech, and healthcare AI, must prioritize valuation discipline and data-driven decision-making.

Buffett's wisdom, "Be fearful when others are greedy and greedy when others are fearful," is a guiding principle for investors navigating the AI market. As India's economy continues to grow, it's essential to balance enthusiasm for AI with a clear understanding of its limitations and potential risks.

Your emphasis on patience and steady wisdom is a valuable lesson for investors and entrepreneurs alike. By prioritizing data-driven decision-making and prudent investment strategies, we can harness the potential of AI while avoiding the pitfalls of hype-driven speculation.

Thank you for sharing your expertise and insights on this critical topic.

Reply