Good personal finance is more about timeless principles and less about market predictions. This was aptly highlighted recently by an article on the Economic Times with seven timeless thumb rules that will suit all classes, jobs, and stages of life. These rules are not at all fashionable or rocket science, but they tend to define financial security.

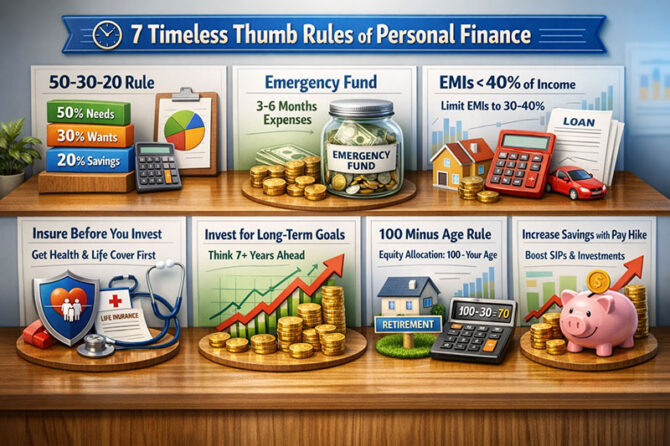

The first is the 50-30-20 rule, which is a model of simplicity that imposes discipline on spending. Allocate 50% of your spending on ‘needs’, 30% for ‘wants’, and set aside at least 20% for savings and investment. A young professional earning an income of ₹1 lakh will have to set aside ₹20,000 for savings before the onset of lifestyle inflation. Internationally, this model has been advocated by Senator Elizabeth Warren, who reminded households that budgeting is not about depriving oneself, it is about ‘priorities.’ This model resonates in the Indian context with the words of the great Mahatma Gandhi, who said, “There is enough for everyone’s need, but not for everyone’s greed.”

But no less important as a foundation stone is the savings of an emergency corpus that would take care of essential expenses for three to six months. Invitations are seldom sent before the event—whether illness, loss of job, or family crises. This corpus could be parked in money market instruments that are risk-free and liquid. As Benjamin Franklin said wisely, “Those who fail to prepare, are preparing to fail.” In India, where responsibilities and healthcare costs could be sudden and substantial, this corpus acts as protective armour.

The third rule reminds us that total EMI payments should be between 30-40% of the take-home pay. The temptation of easy credit can sometimes encourage one to overreach. A family earning ₹1.5 lakh a month should therefore keep all EMI payments below ₹50,000. This helps maintain freedom and saves hard-earned money in hard times. The greatest investor Charlie Munger once advised against the misery of leverage. He said, “The first rule of compounding is to never interrupt it unnecessarily.”

But to pursue investment returns, one needs to insure. And to invest, one needs to insure. This will protect a disciplined saving pattern from being destroyed by a negative experience. Insurance is not an investment; it’s a risk transfer. This becomes important in an Indian family, where medical inflation tends to be higher than overall inflation. Peter Drucker said, “The best way to predict the future is to create it.” Risk protection creates a future.

In terms of growth, equity should be invested in for long-term purposes, usually plans that are more than seven years out, such as retirement, educational funds for one’s offspring, and so forth. Market fluctuations for the short-term market will even out in the long run, and in the meantime, the effects of a compounding inflation rate for idle funds work to the detriment of one’s savings. Warren Buffet’s counsel is as follows: “If you aren’t willing to own a stock for ten years, don’t even think about owning it for ten minutes.”

However, there’s a “100 minus age” formula that makes it easy to manage risk in accordance with age. A person at 30 can invest 70 percent in equities, while a 60-year-old will start moving towards a stable portfolio. This strategy promotes risk management in proportion to age. This has also been stated in Indian epics.

Lastly, and most importantly, the most potent habit would be to boost savings with each pay raise. One does not have to raise one’s lifestyle with each pay raise. Rather, one’s savings habit will automatically translate one’s professional advancement to wealth accumulation. “Spend what’s left after saving” – Jack Bogle. These seven tenets, when combined, create an invisible yet powerful investment compass. There will be market highs and lows, changes in policies, and fluctuations in income, but discipline, prudence, and patience are eternal.

Dr. Prahlada N.B

MBBS (JJMMC), MS (PGIMER, Chandigarh).

MBA in Healthcare & Hospital Management (BITS, Pilani),

Postgraduate Certificate in Technology Leadership and Innovation (MIT, USA)

Executive Programme in Strategic Management (IIM, Lucknow)

Senior Management Programme in Healthcare Management (IIM, Kozhikode)

Advanced Certificate in AI for Digital Health and Imaging Program (IISc, Bengaluru).

Senior Professor and former Head,

Department of ENT-Head & Neck Surgery, Skull Base Surgery, Cochlear Implant Surgery.

Basaveshwara Medical College & Hospital, Chitradurga, Karnataka, India.

My Vision: I don’t want to be a genius. I want to be a person with a bundle of experience.

My Mission: Help others achieve their life’s objectives in my presence or absence!

My Values: Creating value for others.

Leave a reply

Leave a reply