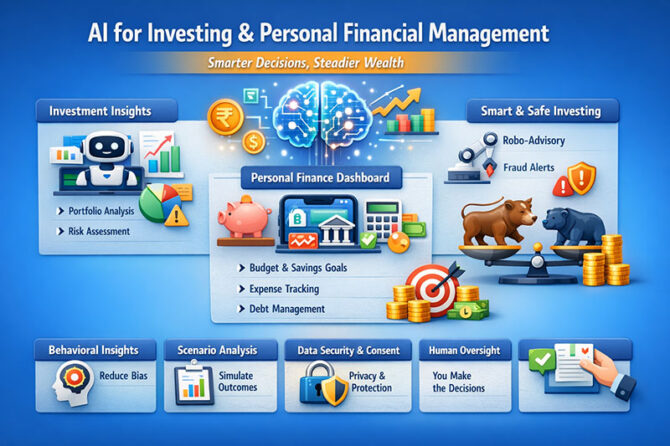

The world of artificial intelligence is transforming the way individuals handle their finances and make investment decisions. What was the domain of the wealthy and institutional trading desks—analysis of investment portfolios, risk management, and behavioural advice—is now possible from the palm of one’s hand. But the power of artificial intelligence for investing and personal finance management is not in “beating the market.”

As Benjamin Graham, the ‘father of value investing,’ wrote in “The Intelligent Investor”, ‘The investor’s chief problem—and even his worst enemy—is likely to be himself.’ Graham’s insight, which predates AI by many decades, is what makes the most important role of AI in finance now behavioural, not predictive.

AI as a Financial Dashboard, Not a Crystal Ball

First and foremost, AI tools provide a clear view of bank and investment accounts, loans, insurance, and cash flow. This in and of itself is revolutionary. Research in the area of behavioural finance has shown that making behaviour visible and providing feedback leads to better behaviour.

Case: A young professional in Pune makes irregular investments in mutual funds but has a credit card balance with high interest. A personal finance application powered by AI points out the negative arbitrage: “You earn 10-12% in equity funds but pay 36-42% a year in credit interest.” It advises the person to pay off debt first. This does not constitute “market timing.” It’s just common sense.

Artificial intelligence in investment: discipline over prediction

Worldwide studies have found that algorithm-driven advice enhances diversification and mitigates some behavioural pitfalls like home bias and overtrading (OECD, Digitalisation and Finance, 2021). Robo-advisory services rely on AI to allocate portfolios according to risk tolerance, investment horizon, and objectives for rebalancing.

One such example is systematic investment planning. Using AI, one can model various SIP amounts based on the level of market volatility and income, and this will assist the investor in making rational contributions to the investment, rather than making it based on emotions. According to Robert Shiller, a Nobel laureate, in the book Irrational Exuberance, “Markets are driven by human narratives as much as by numbers.”

The Indian scenario: structure meets size

The Indian scenario offers a distinct chance to use AI in personal finance. The availability of digital payment trails, mass involvement in mutual funds, and data-sharing models based on consent make holistic financial perspectives possible. The need for suitability, risk profiling, and protection of investors has been stressed time and again in digital models of financial advisories by the Securities and Exchange Board of India.

Nandan Nilekani, thinking about the digital infrastructure that exists in India, wrote, “Technology is not simply a scale enabler but a scale enabler for fairness and for transparency”. In finance, this means that AI can help retail investors with planning services that were only available to high net-worth individuals, if governance and consent are prioritized.

Risk Management and Frauds Awareness

AI is being applied more and more to detecting anomalous transactions, risks of portfolio concentration, and unexpected liquidity imbalances. Research studies on Financial Technologies show that machine learning models are more effective than rules-based approaches in anomaly detection, although human review is still needed.

In the case of an individual, this implies that the system can warn a user about a possible problem, such as an unknown regulation, an over-represented industry, and/or a deterioration in the user’s credit health, but never take an irreversible step without verification.

What AI is not capable of, and what it

It is impossible for an AI system to set your life goals, your tolerance for risk, and your ethical limits. Nor will it provide superior investment performance. As Warren Buffett wrote in his 2013 letter to Berkshire Hathaway shareholders, “Forecasts may tell you a lot about the forecaster, but little about the future.” This applies equally well to investment forecasts generated using an AI system.

This warning is also echoed by global regulators. The OECD and the U.S. CFPB make clear that AI in finance needs to be explainable, fair, and accountable with human responsibility.

One rule that investors can follow:

Use the AI as a decision support tool and not a decision-making one. Let it help in organizing information, pointing out risks, running models of possible outcomes, and maintaining a level head. The decision itself has to be made by humans. In this way, AI is a “silent partner” in wealth creation—less a speculator, more a prudent financial mentor. When paired with wise fundamentals, prudence, and a knowledge of oneself, it may enable investors to accomplish something much more rewarding than merely maximizing profits: staying on track.

Dr. Prahlada N.B

MBBS (JJMMC), MS (PGIMER, Chandigarh).

MBA in Healthcare & Hospital Management (BITS, Pilani),

Postgraduate Certificate in Technology Leadership and Innovation (MIT, USA)

Executive Programme in Strategic Management (IIM, Lucknow)

Senior Management Programme in Healthcare Management (IIM, Kozhikode)

Advanced Certificate in AI for Digital Health and Imaging Program (IISc, Bengaluru).

Senior Professor and former Head,

Department of ENT-Head & Neck Surgery, Skull Base Surgery, Cochlear Implant Surgery.

Basaveshwara Medical College & Hospital, Chitradurga, Karnataka, India.

My Vision: I don’t want to be a genius. I want to be a person with a bundle of experience.

My Mission: Help others achieve their life’s objectives in my presence or absence!

My Values: Creating value for others.

References:

- Graham B. The intelligent investor. Rev ed. New York: Harper & Row; 1973.

- Thaler RH, Sunstein CR. Nudge: improving decisions about health, wealth, and happiness. New Haven (CT): Yale University Press; 2008.

- Organisation for Economic Co-operation and Development. Digitalisation and finance. Paris: OECD Publishing; 2021. Available from: https://www.oecd.org/finance/

- Shiller RJ. Irrational exuberance. 3rd ed. Princeton (NJ): Princeton University Press; 2015.

- Securities and Exchange Board of India. Consultation paper on regulatory framework for robo-advisers. Mumbai: SEBI; 2017. Available from: https://www.sebi.gov.in/

- Nilekani N. Rebooting India: realizing a billion aspirations. New Delhi: Penguin Random House India; 2015.

- Bank for International Settlements. Sound practices: implications of fintech developments for banks and bank supervisors. Basel: BIS; 2022. Available from: https://www.bis.org/

- Buffett W. Berkshire Hathaway shareholder letter. Omaha (NE): Berkshire Hathaway Inc.; 2013. Available from: https://www.berkshirehathaway.com/letters/

- Organisation for Economic Co-operation and Development. OECD principles on artificial intelligence. Paris: OECD Publishing; 2019. Available from: https://oecd.ai/

- Consumer Financial Protection Bureau. Guidance on the use of artificial intelligence and automated systems in consumer finance. Washington (DC): CFPB; 2023. Available from: https://www.consumerfinance.gov/

Leave a reply