Introduction

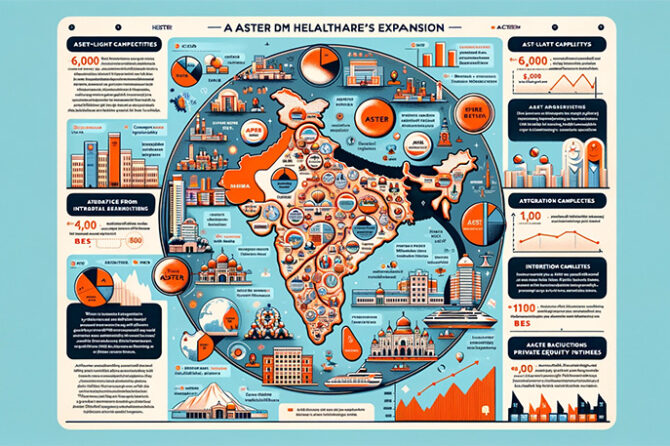

Aster DM Healthcare, a significant player in India’s private healthcare sector, is embarking on an ambitious expansion to establish itself alongside giants like Manipal, Temasek, and Apollo. With a strategic focus on inorganic growth, funding acumen, and an eye on expanding bed capacity, Aster aims to carve a niche in the competitive healthcare landscape.

Strategic Focus on Inorganic Growth

Aster recognizes the importance of mergers and acquisitions (M&As) in driving growth. Targeting high-potential markets in Maharashtra, Pune, Hyderabad, and Uttar Pradesh, the company is poised to exploit opportunities in these regions. This approach is crucial in a landscape where rapid expansion is vital for establishing market dominance.

Funding the Expansion Drive

The recent sale of Aster’s GCC business has significantly enhanced its financial capabilities, allowing it to pursue ambitious acquisition strategies and greenfield projects. Furthermore, the company is actively seeking partnerships with private equity firms to bolster its expansion plans.

Bed Capacity Expansion Strategy

A central aspect of Aster’s strategy is to increase its bed capacity to over 6,000 in India within the next three years. This expansion includes a mix of brownfield and greenfield projects, with a particular focus on enhancing existing facilities and establishing new ones, such as Aster Capital in Trivandrum and Aster MIMS Kasargod.

Shifting Beyond the Asset-Light Model

Traditionally known for its asset-light approach, Aster is now exploring the establishment of regular hospitals, especially in tier-II and tier-III cities. This shift aims to leverage their expertise in smaller markets and cater to local community needs, thus broadening their reach.

Facing the Challenges

While Aster’s ambitions are clear, the path is laden with challenges. The company faces stiff competition from established healthcare providers. Additionally, managing the complexities of M&A integrations and sustaining growth across diverse regions are critical challenges that Aster must navigate

Aster’s Competitive Edge

- Financial Strength: The proceeds from the GCC sale and potential private equity collaborations provide a solid financial foundation for Aster’s plans.

- Proven Expertise: Aster’s successful track record in tier-II and tier-III cities positions it advantageously in these markets.

- Brand Recognition: The established brand of Aster in the healthcare sector facilitates market penetration and trust.

Potential Roadblocks

- Integration Complexities: M&As bring integration challenges that could disrupt operations and impede growth.

- Talent Acquisition: Expanding rapidly in diverse regions requires a skilled workforce, which may be challenging to acquire.

- Market Dynamics: Variations in healthcare regulations and economic conditions could impact Aster’s growth trajectory.

Financial Backing and Investment Climate

Aster’s expansion is underpinned by robust financial strategies, including internal accruals and the sale of the GCC business. The Indian healthcare sector has seen a surge in private equity and venture capital investments, which plays into Aster’s strategy. Major investors showing interest in Aster’s India business indicate a favourable investment climate.

Geographical and Service Expansion

Aster’s regional approach targets untapped potential in less-served areas. The company plans to increase its presence in cities like Hyderabad and states like Uttar Pradesh, viewing these regions as markets ripe for development. The emphasis on tier-II and tier-III cities is a strategic move that differentiates Aster from competitors who focus mainly on metro areas.

Conclusion

Aster DM Healthcare’s expansion strategy in the Indian healthcare sector is a bold move that could significantly alter the industry landscape. The company’s focus on strategic acquisitions, diversified models, and expansion into tier-II and tier-III cities demonstrates a nuanced understanding of market dynamics. However, its success hinges on effectively overcoming integration challenges, maintaining operational efficiency, and managing talent acquisition. Aster’s ability to address these factors will be critical in determining its position in the competitive healthcare market and realizing its aspiration of becoming a leading healthcare provider in India.

Prof. Dr. Prahlada N. B

07 January 2024

Chitradurga.

Leave a reply