Recent data highlighted by The Economic Times in its report titled “Top 10 insurers with highest number of complaints in handling health insurance; Star, Care and Niva among top 3” (February 12, 2026), based on the Council of Insurance Ombudsman Annual Report 2024–25 and IRDAI statistics, draws attention to rising policyholder grievances in India’s health insurance sector. The findings offer a valuable starting point for examining not only service quality and claims management practices but also the broader financial and governance implications for insurers operating in a rapidly expanding healthcare risk market.

Rapid premium growth, expanding coverage under government and private schemes, and rising healthcare costs have made health insurance indispensable. Yet, recent complaint data from the Council of Insurance Ombudsman (CIO) and IRDAI statistics for FY2024–25 reveal troubling signals about service quality, claims management, and governance standards.

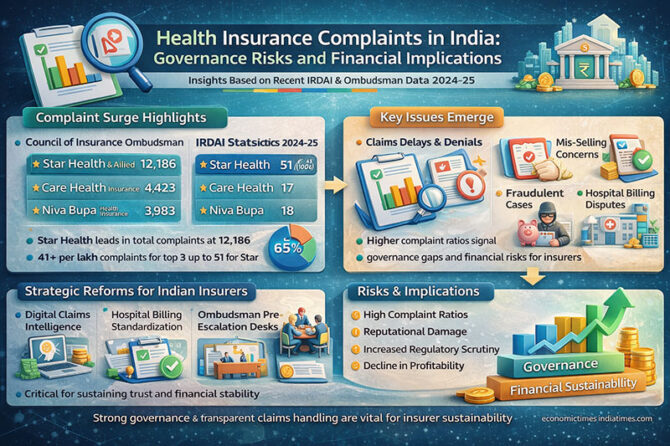

According to the report, Star Health & Allied Insurance recorded 12,186 complaints in FY2024–25, far exceeding peers. CARE Health reported 4,423 complaints, and Niva Bupa 3,983. Even when normalized per lakh policyholders, Star Health’s complaint rate (51 per lakh) remains significantly higher than others. By contrast, public sector insurers such as United India Insurance, despite covering 168 million lives, recorded only 1 complaint per lakh policyholders.

This disparity invites deeper analysis. Absolute complaint numbers alone can be misleading; large insurers naturally face more grievances. However, the per-lakh metric highlights systemic operational stress points—claims settlement delays, communication gaps, mis-selling, denial rates, or network hospital disputes. When complaint ratios are persistently high, it suggests not just customer dissatisfaction but potential process design failures.

From a healthcare management perspective, rising complaints are not merely reputational risks; they are financial liabilities. Every grievance escalated to the ombudsman increases administrative costs, legal provisioning, brand erosion, and customer acquisition expenses. In mature insurance markets such as the United Kingdom and Australia, insurers closely track “complaints per 1,000 policies” as a board-level key performance indicator (KPI). The Financial Conduct Authority (UK) mandates complaint transparency, pushing insurers toward continuous process improvement. Indian insurers must evolve similarly.

The Indian healthcare ecosystem complicates matters further. High out-of-pocket expenditure, uneven hospital billing practices, and rising non-communicable disease burden intensify claim volumes. When policyholders experience partial claim payments or delayed approvals, emotional distress amplifies dissatisfaction. As N.R. Narayana Murthy once observed, “Performance leads to recognition; recognition brings respect; respect enhances power; humility and grace in one’s moments of power enhances the dignity of an organisation.” Insurers that prioritize transparent, dignified customer engagement will ultimately dominate market trust.

Financially, complaint ratios correlate with long-term valuation. Insurers with stronger service records benefit from lower churn, higher renewal rates, and reduced combined ratios. Complaint-heavy insurers risk adverse selection—where healthier policyholders exit and higher-risk pools remain—raising claims ratios further. This spiral can erode underwriting profitability. Globally, Warren Buffett’s insurance philosophy emphasizes disciplined underwriting and reputation preservation. Berkshire Hathaway’s subsidiaries demonstrate how service reliability strengthens float sustainability. The lesson is clear: complaint management is not a soft metric—it is capital protection.

Indian insurers must therefore adopt five strategic reforms:

First, digital claims intelligence. Artificial intelligence–driven claims triaging can reduce processing delays and detect fraud without indiscriminate denials. Globally, insurers like UnitedHealth Group and Allianz deploy predictive analytics to streamline pre-authorizations and minimize disputes.

Second, hospital billing standardization. Many complaints arise from ambiguous exclusions and package deviations. A national digital treatment coding standard—aligned with Ayushman Bharat packages—could harmonize private insurer reimbursements.

Third, transparent product design. Complex exclusions and waiting periods fuel mis-selling complaints. Simple, modular policy designs with standardized definitions across insurers can reduce ambiguity.

Fourth, ombudsman pre-escalation desks. Insurers should establish internal independent grievance review committees before cases escalate externally. Early mediation saves legal costs and preserves customer goodwill.

Fifth, governance-linked executive incentives. Complaint ratios and claim turnaround times should influence management bonuses. What gets measured at the board level improves.

For policyholders and hospital administrators, the data offers practical guidance. Healthcare institutions negotiating corporate tie-ups should assess not just premium competitiveness but complaint ratios and settlement efficiency. Hospitals suffer reputational damage when patients blame them for insurer delays. Strategic insurer partnerships can therefore protect institutional credibility.

From an Indian macroeconomic perspective, health insurance penetration is crucial for financial risk protection. Yet growth without trust is fragile. As Harsh Mariwala has remarked, “Trust is built in drops and lost in buckets.” Complaint-heavy insurers risk losing market confidence at scale.

International comparisons reinforce this caution. In the United States, insurers face class-action litigation and regulatory fines for unfair claim practices. In Germany and Japan, statutory insurance systems enforce tight claims protocols, minimizing disputes. India’s hybrid private-public model requires similar discipline without overregulation.

For investors analyzing listed insurers, complaint data offers an early warning signal. A rising grievance trajectory may precede underwriting stress, regulatory scrutiny, or reputational decline. Conversely, insurers with low complaint-per-lakh ratios demonstrate operational resilience and scalable governance. Financial analysts should integrate grievance metrics into ESG (Environmental, Social, Governance) scoring frameworks.

The opportunity, however, is immense. India’s demographic dividend, expanding middle class, and government-backed insurance schemes ensure long-term sector growth. Insurers that invest now in customer-centric digital architecture, transparent underwriting, and accountable governance can convert today’s complaint crisis into tomorrow’s competitive advantage.

Healthcare financing is ultimately about trust during vulnerability. When families face hospitalization, they seek reassurance—not procedural friction. As Adar Poonawalla has noted in another context, “Scale without systems is chaos.” Health insurers must remember that scale demands robust systems, compassionate communication, and disciplined financial management.

The data from FY2024–25 is not merely a ranking of insurers—it is a governance dashboard for the industry. The next decade of Indian health insurance will belong not to the largest premium collectors, but to the most trusted claim settlers.

Dr. Prahlada N.B

MBBS (JJMMC), MS (PGIMER, Chandigarh).

MBA in Healthcare & Hospital Management (BITS, Pilani),

Postgraduate Certificate in Technology Leadership and Innovation (MIT, USA)

Executive Programme in Strategic Management (IIM, Lucknow)

Senior Management Programme in Healthcare Management (IIM, Kozhikode)

Advanced Certificate in AI for Digital Health and Imaging Program (IISc, Bengaluru).

Senior Professor and former Head,

Department of ENT-Head & Neck Surgery, Skull Base Surgery, Cochlear Implant Surgery.

Basaveshwara Medical College & Hospital, Chitradurga, Karnataka, India.

My Vision: I don’t want to be a genius. I want to be a person with a bundle of experience.

My Mission: Help others achieve their life’s objectives in my presence or absence!

My Values: Creating value for others.

Leave a reply

Leave a reply