Indian healthcare market is going through a period of explosive growth and will likely hit $638 billion in 2025 versus $400 billion in 2024. Hospitals remain the driving force behind this growth and account for nearly 80% of total healthcare spending. One of the metrics of operational efficiency and investors’ interests in this fast-moving world is revenue per doctor. Although tends to be overlooked far too often, this metric presents a highly insightful angle on hospitals’ utilization of their most valuable asset: their doctors.

Studies on India’s largest hospital chains in recent times show wide variations in this parameter. Not only do these variations highlight different strategies but they hold lessons valuable to small and medium hospitals that aspire to survive in a corporate-driven competitive environment.

Revenue per Doctor: Insights from Industry Leaders

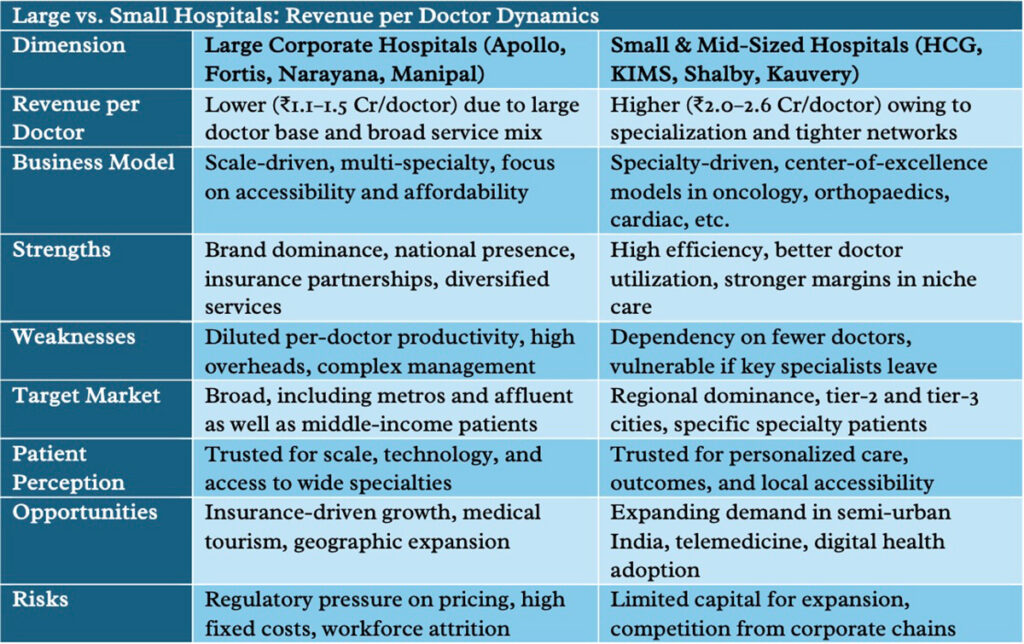

Data reveals that mid-sizes and specialty-focused hospitals are able to produce higher revenue per doctor compared to large diversified chains. For instance, HealthCare Global Enterprises (HCG), a large oncology chain, has approximately ₹2.59 crore revenue per doctor. Similarly, Krishna Institute of Medical Sciences (KIMS) has approximately ₹2.50 crore. Specialization in high-value services such as cancer care, transplants, and advanced surgeries allows higher billing and utilization per doctor.

Such hospitals like Shalby (₹2.10 crore/doctor) and Kauvery (₹2.08 crore/doctor) have high productivity too, though on a smaller level. Shalby has specialization in orthopedics and joint replacement. Kauvery has a dominance in South India.

By way of comparison, multi-specialty behemoths like Apollo (₹1.46 crore/doctor), Fortis (₹1.42 crore/doctor), and Narayana Health (₹1.30 crore/doctor) achieve lower efficiency per doctor. Sheer size, diversification across a wide range of services, and an emphasis on affordability rather than specialization makes numbers appear weaker. Manipal Hospitals, at approximately ₹1.10 crore per doctor, is at the bottom partly due to investments in academia and expenses due to inorganic growth.

The lesson is clear: size too frequently is a sacrifice against per-physician productivity but can be extremely efficient in smaller and niche firms through specialization and tighter networks.

Revenue per Doctor Matters

Revenue per doctor is about more than a financial signal—it’s an indication of how a hospital aligns clinical strength against demand, facilities, and business model. Investors utilize it as a quick profitability and operating lever check. Execs use it to understand if doctors are idle or busy.

Sturdier revenue per doctor typically accompanies higher margins, brisker capital efficiency, and higher return on investment. But this has to be tempered by quality of care and patient outcomes because too intense a focus on revenue can jeopardize patient satisfaction and clinical ethics.

Experience in Designing and Implementing State-of-the-Art

Indian small hospitals are threatened by large hospital networks motivated by brand power, insurance connections, and economies of scales. But the parameter of revenue-per-doctor reveals that size is only a factor in determining successful units. By efficiencies, specialization, and local strengths, small centers can build sustainable and profitable niches.

1. Specialization Focus

Instead of spreading resources thin across a number of specializations, small hospitals can become centers of excellence. By focusing a few high-demand, high-margin specializations such as orthopaedics, oncology, IVF, or ENT, hospitals can enjoy higher doctor throughput. Specialized medicine enjoys higher prices and patient loyalty as well.

2. Enhance Doctor Utilization

Idle time and split schedules diminish productivity. Smaller hospitals can utilize doctor utilization better by optimizing OPD hours, integrating telemedicine consultations, and offering fixed health packages. An example would be packaging diagnostic, consultation, and minor procedures in a single occasion to achieve better efficiency and collection per patient.

3. Utilize Digital Health Tools

Digital technology can expand the reach of each doctor. Teleconsultations, triage driven by artificial intelligence, and electronic records can enable doctors to handle increased patient numbers without compromising quality. Telemedicine in small cities can connect local experts to tertiary experts and produce hybrid streams of revenues.

4.Target Tier-2 and Tier-3 cities

Big corporate hospitals have a presence in metros, and underserved demand is left behind in small cities. Small hospitals can capture small cities, overlaying affordability and personalized attention. With rising insurance penetration and government health schemes, patient numbers in such cities are increasing rapidly.

5. Build Brand on Outcomes, Not Scale

Patients these days expect trust, openness, and results. Smaller hospitals can differentiate themselves by displaying rates of successful treatments, patients’ reviews, and ethical practice. Effective local marketing reduces dependency on heavy advertising and creates inherent referrals.

6. Invest in Training and Retention

Workforce shortages remain Indian healthcare’s biggest danger. Smaller hospitals lose physicians who are recruited by large chains. Flexible work schedules, continued medical education, and performance-based incentives can bring doctor satisfaction on par with hospital growth.

Pros and Cons for Small Hospitals

Emphasis on revenue per doctor has distinct benefits. Small hospitals can show investors they are highly efficient this way, create financially sustainable models, and establish reputational strength within specialties. But it has limitations. Per-doctor revenue that is higher can indicate reliance upon a small pool of specialists, and if major doctors depart, a vulnerable model will remain. It can further create pressure to drive billing to a maximum level potentially at odds with patient-oriented values. So small hospitals have to strike a balance between clinical responsibility and financial efficiency.

Strategic Aft Horizon

With India facing a shortage of hospital beds amounting to 2.4 million and manpower demand projected to double in 2030, healthcare growth opportunity is plentiful. Smaller and medium hospitals have such opportunities only if they aim at high-value niches, exploit digital technology, and become highly productive per doctor.

Large hospital networks will continue to lead in size and reach but small hospitals can be winners on specialization and efficiency. Revenue per doctor, along with patient outcomes and missions driven by a sense of ethics, can be pillars on which competitiveness can be constructed.

Final thoughts

India’s hospital market presents a clear trade-off: Large hospital chains achieve maximum scale and reach, while small hospitals achieve optimum doctor efficiency per hospital through specialization and peak use. It’s not a financial goal only but a survival and growth tool in a consolidating market for this measure applied to small hospitals. By specialization, use of technology, and peak doctor-workforce efficiency, small hospitals can be agile, reputable, and successful participants in India’s evolving healthcare landscape.

Dr. Prahlada N.B

MBBS (JJMMC), MS (PGIMER, Chandigarh).

MBA in Healthcare & Hospital Management (BITS, Pilani),

Postgraduate Certificate in Technology Leadership and Innovation (MIT, USA)

Executive Programme in Strategic Management (IIM, Lucknow)

Senior Management Programme in Healthcare Management (IIM, Kozhikode)

Advanced Certificate in AI for Digital Health and Imaging Program (IISc, Bengaluru).

Senior Professor and former Head,

Department of ENT-Head & Neck Surgery, Skull Base Surgery, Cochlear Implant Surgery.

Basaveshwara Medical College & Hospital, Chitradurga, Karnataka, India.

My Vision: I don’t want to be a genius. I want to be a person with a bundle of experience.

My Mission: Help others achieve their life’s objectives in my presence or absence!

My Values: Creating value for others.

References:

- Healthcare Global Enterprises (HCG). Annual Report FY2022. HCG Oncology. Available from: https://www.hcgoncology.com/wp-content/uploads/2022/09/HCG-AR-FY2022.pdf

- “HCG Q4 revenue rises 18% YoY, FY25 revenue up 16%.” BW Healthcare World, May 2025. Available from: https://www.bwhealthcareworld.com/article/hcg-q4-revenue-rises-18-yoy-fy25-revenue-up-16-557874

- “HCG revenue increases 18%, PAT drops 66% in Q4FY25.” Medical Buyer, May 2025. Available from: https://medicalbuyer.co.in/hcg-revenue-increases-18-pat-drops-66-in-q4fy25

- “Indian Hospital Sector: A Multi-Decade Compounder in the Making.” SOIC Research Blog. Available from: https://www.soic.in/blog-page/indian-hospital-sector-a-multi-decade-compounder-in-the-making

- “ET Analysis: Indian hospital chains report revenue growth, expansion plans amidst regulatory concerns.” Economic Times, June 2024. Available from: https://m.economictimes.com/industry/healthcare/biotech/healthcare/et-analysis-indian-hospital-chains-report-revenue-growth-expansion-plans-amidst-regulatory-concerns/articleshow/110676223.cms

- CRISIL Research. Assessment of the Healthcare Delivery Industry in India. Yatharth Hospitals (Industry Report). Available from: https://www.yatharthhospitals.com/uploads/industry-report/assessment-of-the-healthcare-delivery-industry-in-India.pdf

- “Shalby Hospitals.” Wikipedia. Available from: https://en.wikipedia.org/wiki/Shalby_Hospitals

- “Krishna Institute of Medical Sciences (Hospital Group).” Wikipedia. Available from: https://en.wikipedia.org/wiki/Krishna_Institute_of_Medical_Sciences_(hospital_group)

- Indian Hospital’s Revenue per Doctor – Key Insights

*Dear Dr. Prahlada N.B Sir,*

Your article on Indian hospitals' revenue per doctor is insightful and thought-provoking.

You've highlighted the importance of specialization, efficient doctor utilization, and digital health tools for small hospitals to thrive.

Key Takeaways :

*Specialization*: Focus on high-demand, high-margin areas to boost productivity and revenue.

*Efficient Utilization*: Optimize OPD hours, leverage telemedicine, and offer fixed health packages.

*Digital Tools*: Expand doctor reach and improve patient care through technology.

Your dedication to healthcare and knowledge sharing is inspiring. Your article is a valuable resource for small hospitals and healthcare professionals.

Reply