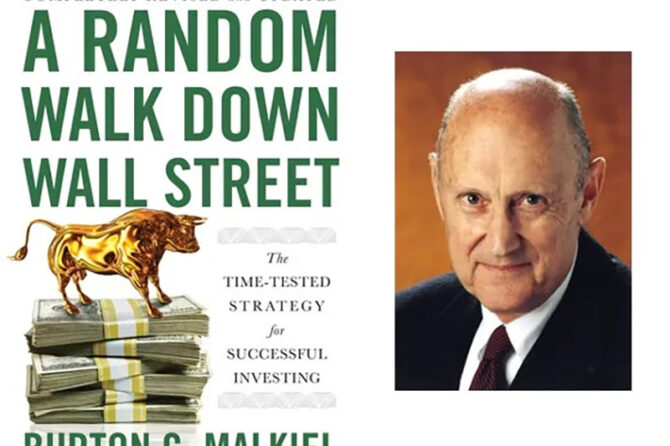

“A Random Walk Down Wall Street,” published for the first time in 1973, continues to this day, with numerous revisions, to rank among the most widely quoted—and contentious—investments on the subject of modern finance. The thrust of the book, penned by Burton G. Malkiel, still disturbs the existing premises of mainstream market analysis: stock market activity cannot be predicted, and the good efforts of experts are, for the most part, mere wishful thinking. In the words of the author: “A blindfolded monkey throwing darts at the Wall Street journals could do just as well.”

The underlying premise of the book is the random walk theory, where the movement of stock prices is shown to follow a path that cannot be distinguished from randomness. This chilling idea is explained through beautiful analogies. His famous example of stock price movement is likened to a drunken man taking steps on the sidewalk: “One step does not predict the next, and the progression is about as random as flipping a coin.” This is simply not intuitive for the average individual. It is only natural for the human brain to seek patterns, which is hinted at by Malkiel when he says that market players “see shapes, cycles, and charts where none exist.”

The book effectively demonstrates how readily the trap of apophenia, the identification of patterns where none exist, springs on unwary investors. It is tempting, for example, to picture tossing a coin each day, calling heads a price increase and tails a price break, and discovering that the resultant curve cannot readily be distinguished from that of a stock price. Such a parallel is one of the strongest analogies drawn throughout the book. Our brains simply prefer patterns, and markets do not always accommodate us.

Malkiel dissects the major schools of thought of technical analysis systematically, reviewing each approach with respect, but also with vigorous skepticism. He explains systems of analysis, for example, the Filter Rule, which recommends purchasing shares of stock that have moved a predetermined percentage from their base, or the Dow Theory, which hinges on the idea of support and resistance points. He also looks at the Price-Volume schemes, where large volumes of stock reinforce the correctness of a particular market movement. There is no mistaking the author’s judgment: “Technical analysis is an illusion. Its tools cannot predict stock prices any better than a crystal ball.”

These approaches, he asserts, provide no lasting edge over the following very simple approach: investing in and holding a diversified portfolio for the long term. “Most investors,” he writes, “would be better off investing in index funds and ignoring the experts.” His argument is not strictly academic but also statistical, empirical, and systematically documented. Many years of data on the market have consistently shown that, despite elaborate analysis and virtually unlimited capital, professional portfolio managers often fail to match the market.

However, the book is not nihilistic. Malkiel does not argue that investing is not worth the trouble. On the contrary, he is of the view that it is impossible to predict the stock market, but it is sensible and lucrative to invest. By accepting the randomness of the stock market, a person emancipates himself or herself from the clutches of emotional trading, costly speculation, and the irresistible attraction of “hot tips.” As Malkiel aptly says, “The surest way to get rich in the stock market is to avoid being scared out of it.” The relevance of his argument in the current era is astounding. In the current era of algorithm trading, social media-driven stock speculation, meme stock trading, and sophisticated stock market indicators, the relevance of the central argument that markets keep changing, but randomness continues, cannot be underestimated. Even the most sophisticated trading strategies fail when compared with the strategy advocated by Malkiel.

Final thoughts:

A Random Walk Down Wall Street is not only a book about finance, but it is also a philosophical battle with uncertainty. It provides a somewhat chilling but very freeing view for the seasoned investor and the novice: accept the randomness, resist the illusions, and make the journey. This advice, given by Malkiel, carries the weight it does because it is not about the future, but it is about humility, the one commodity that is the rarest and most valuable thing in the world of finance.

Dr. Prahlada N.B

MBBS (JJMMC), MS (PGIMER, Chandigarh).

MBA in Healthcare & Hospital Management (BITS, Pilani),

Postgraduate Certificate in Technology Leadership and Innovation (MIT, USA)

Executive Programme in Strategic Management (IIM, Lucknow)

Senior Management Programme in Healthcare Management (IIM, Kozhikode)

Advanced Certificate in AI for Digital Health and Imaging Program (IISc, Bengaluru).

Senior Professor and former Head,

Department of ENT-Head & Neck Surgery, Skull Base Surgery, Cochlear Implant Surgery.

Basaveshwara Medical College & Hospital, Chitradurga, Karnataka, India.

My Vision: I don’t want to be a genius. I want to be a person with a bundle of experience.

My Mission: Help others achieve their life’s objectives in my presence or absence!

My Values: Creating value for others.

Leave a reply

Dear Dr. Prahlada N. B Sir,

Namaste! 🌟 Your review of "A Random Walk Down Wall Street" is a breath of fresh air, reminding us that humility is key in finance. The stock market's randomness is like a drunken man on the sidewalk – unpredictable! Your words are a timely reminder to accept uncertainty and resist illusions.

Thank you for sharing your wisdom. Your vision, mission, and values inspire us to create value for others. May your tribe increase!

Reply