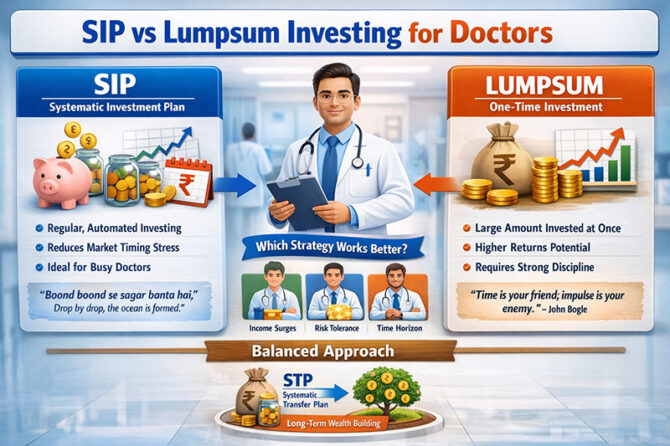

Doctors spend a considerable part of their working lives advising patients based on evidence, discipline, and potential outcomes. Ironically, for a doctor dealing with personal finance, they struggle not because they earn less, but because they have irregular cash flows, limited time, and emotional exhaustion. One such question raised by them during my recent webinar on “Winning Markets with Prahlada,” is whether they should opt for systematic investment schemes (SIP) or lump sums.

The correct answer is not ideological; rather, it depends on the context, conduct, and profession.

The Reality of a Doctor’s Income Curve

In contrast to other white-collar workers, doctors may face irregular income sources such as intermittent consultations, surgeries, bonuses, private practice profits, speaking engagements, or selling investments. Regarding the mathematical aspect, the lump sum initially withdrawn generally results in greater potential returns, with the investments left for a longer period.

This claim is based on the evidence. Research conducted by Vanguard on the timing of investments showed that in two-thirds of the periods tested in developed markets, the lump-sum approach performed better than averaging (Vanguard Research, 2012). In the long run, financial markets tend towards an upward trend.

However, doctors do not work in a theoretical market but are involved in a real market environment.

SIP is used as a mechanism to address the cognitive burden.

In fact, medicine is a cognitively demanding field, and decision fatigue is a real constraint. After a 12-hour outpatient clinic or a complex surgery, many healthcare professionals would not have enough bandwidth to actively participate in markets or react to volatility.

Systematic Investment Plans (SIPs) work more like stabilizers for behaviour rather than maximizers. Research on the nature of investor behaviour undertaken by the Securities and Exchange Board of India (SEBI) suggests that individual investors who engage in market timing tend to underperform, acting on emotions when the market is volatile. (SEBI Investor Education Series, 2020)

Indeed, the saying by the renowned investor, Warren Buffett, “The stock market is a way of transferring money from the impatient to the patient.” (Berkshire Hathaway Annual Letter)

A Clinical Example of Immediate Comprehension

For example, hypertension can be considered. One aggressive approach may quickly drop blood pressure, yet long-term control relies on consistent compliance rather than sporadic treatment. Thus, SIPs play a role analogous to financial antihypertensives; that is, gradual and steady and resistant to behavioural swings.

Indian wisdom “Boond boond se sagar banta hai” means “the ocean gets formed drop by drop” and contains this tenet. Association of Mutual Funds in India (AMFI) data of long-term returns of SIPs over ‘15-20 years has revealed consistent generation of wealth that has beaten inflation rates.

When Lumpsum Makes Sense for Doctors

Lumpsum investing is appropriate when a doctor:

- Receives a large one-time inflow (practice sale, inheritance, retirement corpus).

- Has a long investment horizon (10+ years).

- Possesses emotional resilience to tolerate interim drawdowns.

Research by Morningstar on “Investor Return Gaps” suggests that investors who have been completely invested outperform investors who have staggered their investments or have withdrawn money during periods of market turmoil (Morningstar, 2015).

”An investment in knowledge pays the best interest”

“Time is your friend; impulse is your enemy.”

(Bogle on Mutual Funds, 1993)

The Chief Difficulty: Physician-Investor Psychology

Several studies, such as the ones found in the Journal of Financial Planning, suggest that dollar-cost averaging does not optimize portfolio return growth, but it does avoid the possibility of making a worse decision (Leggio & Lien, 2003). Dollar-cost averaging is, therefore, a good option for physicians with the dual risk responsibilities mentioned above.

Benjamin Graham’s sage advice is especially important for high-paying professionals: “The investor’s main trouble—and even his worst enemy—is likely to be himself.”

(The Intelligent Investor, 1949).

A Practical Prescription for Physicians

The most sensible course for doctors would be to opt for the middle path, namely focusing on SIP while also planning their deployments in a structured way. Seasoned physician investors usually start routing their lump sums through Systematic Transfer Plans, distributing the sums to equity funds, thus dividing investments between exposure and comfort, as recommended by SEBI mutual funds.

Final Clinical Implication

In the investment world, like in the medical profession, the best procedure would always be the one that the patient can stick to all the time. For doctors, the best procedure would always be the one that:

- Needs minimal daily attention,

- Aligns with emotional bandwidth, and

- Holds capital invested over long-term horizons.

There is a payoff to discipline, an advantage to patience that leads to acquiring wealth. It is better to be consistently strong rather than occasionally brilliant: this is something that practitioners know all.

Dr. Prahlada N.B

MBBS (JJMMC), MS (PGIMER, Chandigarh).

MBA in Healthcare & Hospital Management (BITS, Pilani),

Postgraduate Certificate in Technology Leadership and Innovation (MIT, USA)

Executive Programme in Strategic Management (IIM, Lucknow)

Senior Management Programme in Healthcare Management (IIM, Kozhikode)

Advanced Certificate in AI for Digital Health and Imaging Program (IISc, Bengaluru).

Senior Professor and former Head,

Department of ENT-Head & Neck Surgery, Skull Base Surgery, Cochlear Implant Surgery.

Basaveshwara Medical College & Hospital, Chitradurga, Karnataka, India.

My Vision: I don’t want to be a genius. I want to be a person with a bundle of experience.

My Mission: Help others achieve their life’s objectives in my presence or absence!

My Values: Creating value for others.

Leave a reply

Leave a reply