In the rapidly evolving prospect of the Indian pharmaceutical industry, Emcure Pharmaceuticals Limited’s recent announcement of a $500 million Initial Public Offering (IPO) at a $3 billion valuation marks a significant strategic move. Spearheaded by Namita Thapar, the IPO reflects a combination of expertise, confidence, and a positive profit margin of ₹400 crore. This development offers a lens through which to examine the company’s strategic positioning, challenges, and growth prospects in a burgeoning market.

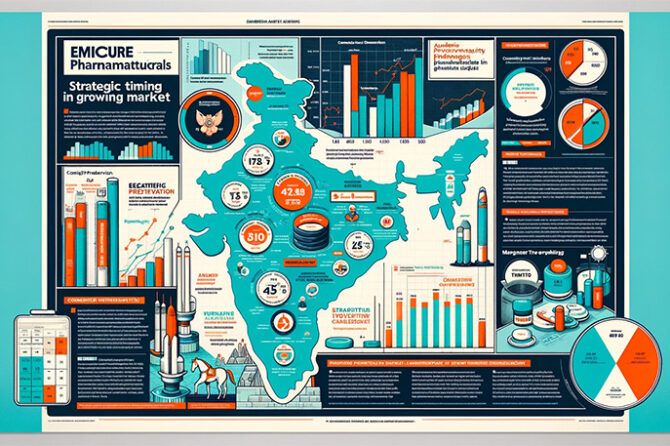

Strategic Timing and Market Dynamics

The decision to launch an IPO at this juncture is highly strategic, considering the projected trajectory of the Indian Pharma Industry. With an expected growth to $130 billion by 2030 at a CAGR of 22%, the industry presents a fertile ground for pharmaceutical companies to expand and thrive. Emcure’s IPO at a valuation of 4.1 times its sales capitalizes on this growth potential, positioning the company to leverage market dynamics effectively.

Equity Preservation: A Historical Perspective

Emcure’s approach to managing its equity is rooted in a lesson from the past, where founders and promoters showed a strong preference for retaining equity over seeking VC funding. This philosophy is evident in Emcure’s capitalization table, with a significant share of 48.05% held by promoters and 33.55% by their family members. The presence of Bain Capital with a 13.09% stake and other shareholders at 4.23% demonstrates a balanced approach to equity distribution, reflecting a cautious yet ambitious growth strategy.

Comparative Valuation in the Pharma Sector

The valuation of Emcure at 4.1 times its revenue is a strategic positioning, slightly below the industry’s top-10 average of 4.9 times. This valuation is a function of the direct relationship between profitability and valuation in the pharmaceutical sector. Comparatively, companies like Sun Pharma and Torrent Pharmaceuticals, with higher profitability, enjoy higher valuations. Emcure’s current profitability margin of 6.9% highlights its potential for growth and the need for strategic financial management.

Addressing Profitability Challenges

A critical challenge for Emcure has been its profitability margin, lagging behind industry leaders. The company’s high external borrowing of ₹2,300 crore, leading to significant interest payments, has been a substantial drag on its profits. The IPO’s allocation of ₹1,100 crore towards debt repayment is a strategic move to alleviate this burden and potentially increase profitability to over 10%, a significant leap towards financial sustainability.

Bain Capital’s Strategic Exit

The IPO also serves as a strategic exit for Bain Capital, allowing it to realize an 11.7 times return on its investment of ₹262 crore in 2006. This translates to a CAGR of 63%, exemplifying the potential for high returns in the pharmaceutical sector through strategic investments and partnerships.

R&D Investment: A Double-Edged Sword

Emcure’s reduced R&D expenditure, now at 3.8% of sales from a previous high of 5.2%, raises concerns regarding its long-term innovation and development capacity. While this reduction may contribute to short-term profitability, it poses questions about the company’s ability to sustain innovation and competitiveness in the long run, especially in an industry driven by constant research and development.

Growth Prospects Amidst Challenges

The company’s growth strategy appears to be centered around optimizing existing capacities and expanding market distribution. However, with growth expected to stabilize at a sustainable 10% year-on-year, Emcure faces the challenge of balancing its expansion with the need to invest in innovation and R&D. The company’s strong position in specific market segments like HIV antivirals, gynaecology, and blood-related treatments, coupled with its international expansion, including the development of a COVID-19 vaccine, provides a solid foundation for growth.

Market Leadership and Expansion

Emcure’s market leadership in key therapeutic areas, notably HIV antivirals, where it holds a 51.53% market share, gynaecology (11.85%), and blood-related treatments (10.26%), is a significant strength. The company’s expansion into 70 countries and its initiatives in vaccine development through an in-house mRNA platform are strategic moves that promise to enhance its global footprint and market influence.

The final word

Emcure Pharmaceuticals’ IPO is not just a financial milestone but a strategic move that underscores the company’s confidence in its growth trajectory and market positioning. While it navigates challenges in profitability and R&D investment, its robust market presence, strategic equity management, and expansion strategies signal a promising future. As the Indian pharmaceutical industry continues to grow, Emcure’s journey will be a key indicator of the sector’s potential and the strategic acumen required to succeed in this dynamic market.

Prahlada N. B

22 November 2023

Chitradurga.

Prahlada Sir 💐

Strategic timing & understanding of market dynamics play a crucial role for any pharmaceutical company to thrive & gain.

Emcure Pharmaceuticals, established in 1981, is a prominent one in Indian pharmaceutical industry ; Emcure focuses on therapeutic areas such as cardiology, oncology, nephrology & critical care, & now wants to try manufacturing covid-19 vaccine.

At present, Emcure is exporting it’s products to 70 countries & has leapfrogged it’s peers , by getting ranked as the 9th largest company in Indian Pharma market, in April 2023 by AICOD-AWACS.

With announcement of $ 500 million IPO (Initial Public Offering) , by Emcure’s head Ms Namitha Thapar, expecting a gain of Rs 400 crore profit, the strategy appears to be optimising existing capacities & expand market distribution.

All this augurs well for Emcure’s growth & expansion👌🏿💐🤩.

Reply