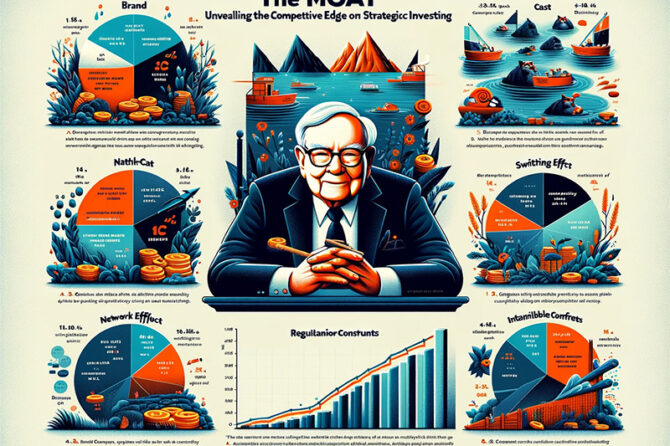

In the 6M’s of Strategic Investing Approach for Doctors, the second M stands for “Moat.” This concept is a crucial criterion formulated to guide investors in making informed decisions. When applied diligently, the principle of the Moat can unveil the true potential of a business.

According to Warren Buffet, one of the most acclaimed investors of our time, a “moat” is a metaphorical term used to describe a company’s sustainable competitive advantage. This concept draws inspiration from medieval castles, where a moat is a deep, broad ditch filled with water that surrounds the castle, serving as a primary line of defence against invaders. This advantage, whether stemming from brand strength, cost leadership, high switching costs, network effects, regulatory constraints, or intangible assets, acts as a buffer against inflation and competition, solidifying the company’s monopolistic position in the market.

In the context of business and investment, Buffet uses the term to refer to any attribute of a company that gives it a distinct advantage over its competitors, allowing it to protect its market share, profitability, and long-term viability. This advantage makes it difficult for rivals to encroach on its territory, much like a moat prevents intruders from penetrating a castle.

A company’s moat can derive from various sources, such as a strong brand identity, unique technology or patents, cost advantages, customer loyalty, efficient scale, network effects, or regulatory barriers. These moats enable companies to generate higher returns on investment and sustain their success over extended periods, making them attractive investment opportunities.

Buffet’s emphasis on investing in companies with a strong moat stems from his long-term investment philosophy. He believes that these companies are likely to offer steady returns and withstand economic downturns or competitive pressures, thereby providing more reliable and consistent investment growth.

Types of Moats and Their Impact in Business

Investing in companies with a strong competitive advantage, or “moat,” is crucial for long-term success. This concept, popularized by Warren Buffet, highlights the importance of identifying businesses that can sustain their market dominance. Below, we delve deeper into the types of moats and their impacts on a company’s standing in the market.

Brand Moats: The Power of Recognition and Loyalty

A brand moat is established when a company has built strong brand recognition and loyalty. This type of moat is often seen in companies that have become synonymous with the product or service they offer (e.g., Coca-Cola in soft drinks or Apple in smartphones). Strong brand recognition can lead to a loyal customer base that is less sensitive to price changes and more likely to make repeat purchases. This loyalty can also serve as a barrier to entry for competitors, as breaking consumer habits or preferences can be exceptionally challenging.

Cost Moats: Leading Through Efficiency

Cost moats arise when a company can maintain lower operational costs compared to its competitors, allowing it to offer lower prices or enjoy higher profit margins. This can be achieved through economies of scale, more efficient production techniques, or exclusive access to low-cost materials. Companies like Walmart and Amazon demonstrate cost moats by leveraging their massive scale to negotiate lower prices from suppliers, which they then pass on to consumers.

Switching Cost Moats: Creating Customer Stickiness

Switching cost moats develop when high costs, inconvenience, or other factors discourage customers from changing brands or providers. This can include monetary costs, time investment, or effort required to switch. For example, enterprise software companies often benefit from this type of moat as their products become deeply integrated into a customer’s business operations, making switching both costly and disruptive.

Network Effect Moats: The Virtuous Cycle of Growth

Network effect moats occur when the value of a product or service increases as more people use it. Social media platforms like Facebook or services like Airbnb are examples where the user experience improves as the user base grows, creating a virtuous cycle that attracts even more users. This effect can create a significant barrier for competitors, as they struggle to match the value provided by a large, established user network.

Regulatory Constraints: Barriers Imposed by Law

Regulatory constraints can create moats by limiting competition through legal barriers. This is common in industries like utilities or telecommunications, where regulatory requirements make it difficult for new competitors to enter the market. Additionally, companies that have managed to navigate complex regulatory landscapes can benefit from the hurdles these regulations pose to potential new entrants.

Intangible Assets: Leveraging Intellectual Property and Technology

Intangible assets, including patents, trademarks, and proprietary technology, form another type of moat. These assets can provide exclusive rights to produce a product, use a certain technology, or utilize a specific brand identity, thereby preventing competitors from replicating their success. Pharmaceutical companies with patented drugs or technology companies with unique algorithms are prime examples of businesses that utilize intangible assets to maintain a competitive edge.

The Strategic Importance of Moats

In summary, understanding and identifying the types of moats that a company possesses can provide significant insight into its long-term viability and competitive position in the market. From brand loyalty and cost leadership to regulatory barriers and intangible assets, these moats serve as protective barriers, enabling companies to thrive and maintain their dominance in an ever-competitive business landscape.

Next: How to identify companies with a Moat?

Prof. Dr. Prahlada N. B

11 December 2023

Chitradurga.

[…] Next: What is the, “MOAT?” […]

ReplyPrahlada Sir 👏

Thanks for introducing us to concept of "MOAT", in strategic investing in any company.

The 'moat' is an economic concept,first introduced by Warren Buffet, that describes a company's sustainable competitive advantages, that help it maintain its market position and profitability. Understanding a company's moat can help investors identify companies with a strong competitive advantage that can protect their long-term profitability

The following advantages can be had

before investing…. by knowing the moat of a company :

* Companies with a strong moat are more likely to generate consistent cash flows and earnings over the long term.

* Knowing the moat of a company can help investors estimate its intrinsic value by considering the company's future cash flows, earnings, and growth prospects.

* Understanding the moat of a company can help investors avoid making impulsive or emotional investment decisions based on short-term market movements.

In summary,

Reply………. knowing the moat of a company before investing can help investors identify companies with sustainable competitive advantages, assess their future growth prospects, determine their intrinsic value and make more informed investment decisions.