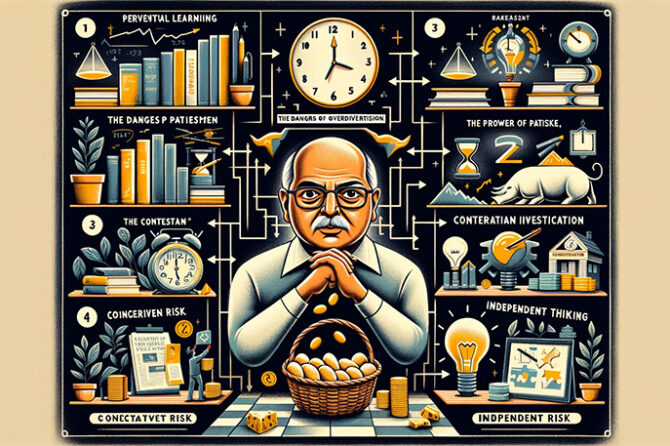

Rakesh Jhunjhunwala, the “Big Bull” of Dalal Street, stands as a titan of Indian investing. His journey from a $1 capital to a $15 billion fortune is a testament to his acumen, discipline, and unwavering belief in his strategies. While replicating his success might be elusive, understanding his core philosophy can equip you with valuable insights for your own investment journey.

1. Perpetual Learning:

Jhunjhunwala was an ardent believer in continuous learning. He devoured financial publications, researched companies relentlessly, and sought guidance from seasoned investors. His thirst for knowledge fuelled his understanding of markets, enabling him to identify hidden gems and navigate volatile conditions.

Quote: “I spend five to six hours a day reading. I read a lot of research reports, annual reports, and newspapers. I keep myself updated on what is happening in the world.”

2. The Dangers of Over diversification:

While diversification is crucial for mitigating risk, Jhunjhunwala cautioned against spreading oneself too thin. He preferred concentrated bets on companies he thoroughly researched and believed in, allowing him to reap substantial returns on successful investments.

Quote: “I don’t believe in diversifying for the sake of diversification. I would rather put all my eggs in one basket, which I know well.”

3. The Power of Patience:

Jhunjhunwala was a firm advocate for long-term investing. He understood that the market moves in cycles, and short-term fluctuations shouldn’t cloud long-term potential. His patience allowed him to ride out market downturns and reap the rewards of compounding returns.

Quote: “The stock market is not a place to get rich quickly. It is a place to get rich slowly.”

4. Learning from Mistakes:

Even the best investors make mistakes. Jhunjhunwala readily acknowledged his missteps and used them as valuable learning experiences. He constantly refined his strategies and honed his risk management skills to avoid repeating past errors.

Quote: “It is not that I don’t make mistakes. I make mistakes, but I try to learn from them.”

5. Contrarian Investing:

Jhunjhunwala often went against the crowd, buying stocks when others were selling and selling when they were buying. His contrarian approach allowed him to capitalize on market inefficiencies and unearth undervalued gems.

Quote: “Buy right and sit tight. Don’t be a market timer.”

6. Independent Thinking:

Jhunjhunwala was wary of blindly following investment tips. He encouraged investors to conduct their own research, understand the fundamentals of companies, and develop their own convictions before making decisions.

Quote: “Don’t follow tips blindly. Do your own research and invest based on your conviction.”

7. Embracing Risk:

Jhunjhunwala understood that taking calculated risks was inherent to successful investing. He didn’t shy away from high-conviction bets, but always ensured proper risk management to mitigate potential losses.

Quote: “Risk is an essential part of investing. If you want to get ahead, you have to take some risks.”

Jhunjhunwala’s legacy extends beyond his vast wealth. His investment philosophy provides invaluable lessons for every investor, regardless of experience or capital. By incorporating his principles of continuous learning, focused research, and patient conviction, you can equip yourself to navigate the market with greater confidence and potentially build your own investment success story.

Bonus Tips:

- Conduct a thorough fundamental analysis before investing in any company.

- Develop a well-defined risk management strategy to limit potential losses.

- Invest for the long term and avoid short-term market fluctuations.

- Continuously educate yourself about the market and different investment strategies.

- Remember, no single investment philosophy guarantees success. Adapt and refine your approach based on your own risk tolerance and financial goals.

Remember, replicating Jhunjhunwala’s exact strategies might not be feasible for everyone. However, by understanding his core principles and adapting them to your own circumstances, you can pave the way for a more informed and potentially successful investment journey.

I hope this revised and expanded article provides a more comprehensive and insightful look into Rakesh Jhunjhunwala’s investment philosophy.

References:

- “Rakesh Jhunjhunwala: The Big Bull of India” by Tamal Bandopadhyay

- “Rakesh Jhunjhunwala: Investing Mantras of a Market Master” by Abhijit Ghosh

- “The Warren Buffet of India: Rakesh Jhunjhunwala’s Investment Strategies” by Santosh Kumar.

Prof. Dr. Prahlada N. B

14 January 2024

Chitradurga.

Yes Prahlada Sir,

Rakesh Jhunjhunwala, often referred to as the ' Warren Buffet of India ',was a renowned investor in Indian stock market.

Jhunjhunwala's journey from humble beginnings to billionaire status, is truely inspiring & instructive.

Jhunjunwala, fondly called the 'big bull' of Dalal street started investing in stock market, in the year 1985.

He started his career with just ₹ 5000 of borrowed money, & ended up with net worth of 42,394 crores, at the time of his death, in 2022, when he was just 62 year old .

His investment philosophy had several key factors, as told by you :

* He used to identify companies with long- term growth potential & never went after short-term gains.

*He used to evaluate the financial health, management quality, competitive position & growth prospects of a company, before making investment.

* He always followed closely the businesses of the company he invested in, & also the broader market dynamics.

Overall, Rakesh Jhunjhunwala's investment philosophy revolved around thorough research, long- term perspectives & willingness to take calculated risks.His success in Indian stock market , serves as a guide & inspiration to all beginners , in stock market investment.

Reply